Nifty 50 & Bank Nifty Post-Market Analysis for 31st July 2025 — Trading Strategy for 1st August 2025

Key Takeaways

- Both Nifty 50 and Bank Nifty faced selling pressure towards the close, erasing intraday gains.

- Nifty closed at 24,765.60, down 80 points from day’s high.

- Bank Nifty slipped below 56,000 psychological support, closing at 55,992.65.

- Weakness in global markets and FII outflows weighed on sentiment.

- Volatility increased as India VIX rose by 2.3%.

Price Action Breakdown

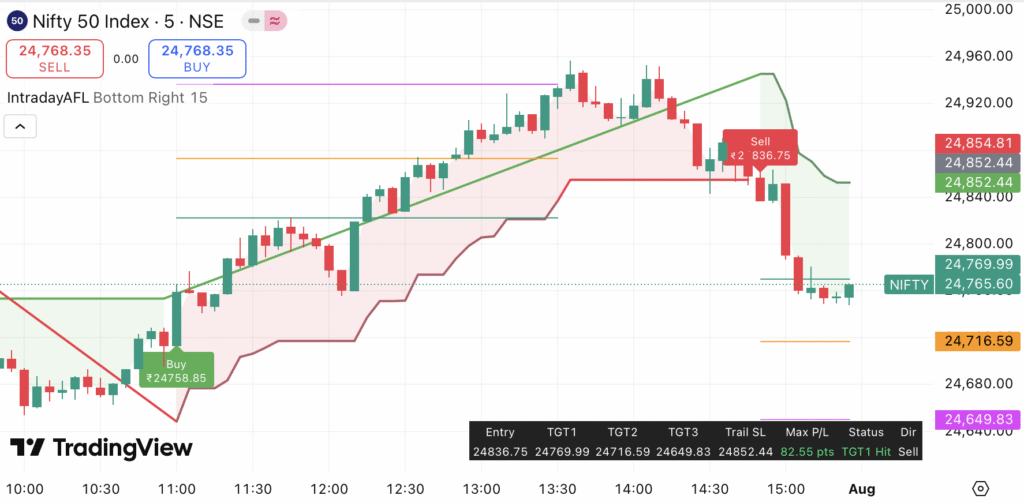

Nifty 50 Overview

Nifty 50 opened with a positive gap, climbing to a high of 24,920 levels. However, selling pressure emerged post-lunch as weak cues from European markets dragged it down. A sharp sell-off in the last hour pulled Nifty towards 24,765.60, near day’s low.

On the 15-minute chart, a double-top formation was visible near 24,920, signaling a bearish reversal. The index broke below intraday support of 24,800, confirming weakness.

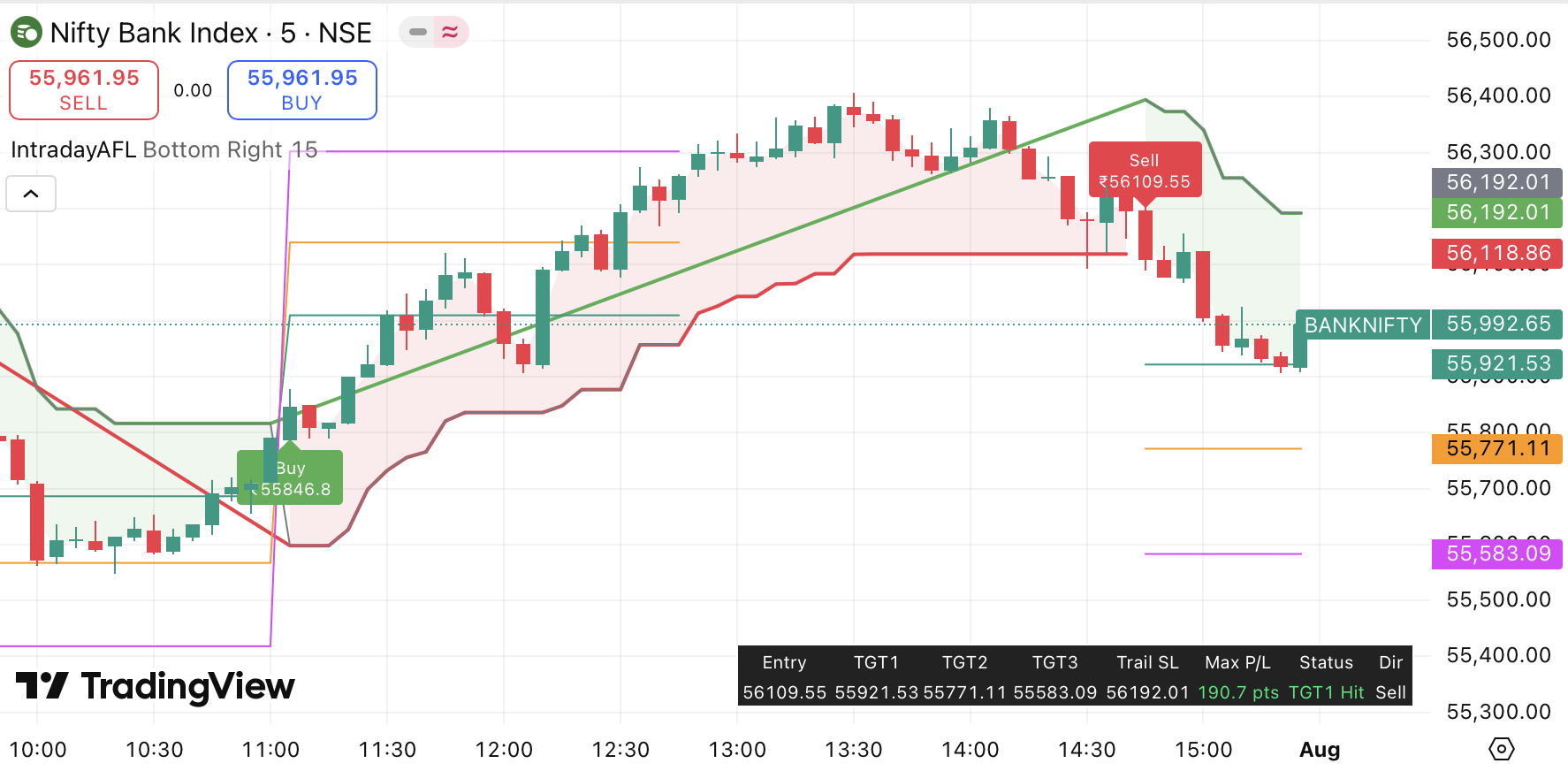

Bank Nifty Overview

Bank Nifty showed initial strength, testing 56,400 resistance but faced sharp profit booking in afternoon trade. The index broke down below 56,100, a critical level, and closed at 55,992.65. A bearish engulfing candle on the 15-minute timeframe indicated strong seller dominance.

Private banks underperformed while PSU banks remained flat.

Check Free Live Buy-Sell Chart Here

Global Market and Macro Updates

- US futures remained flat after a mixed closing on Wall Street.

- European indices like FTSE and DAX were trading in red, reacting to weaker-than-expected earnings.

- Brent Crude hovered around $83/barrel, adding pressure on inflation expectations.

- Rupee depreciated by 15 paise against USD, closing at 83.25.

- FII data showed net outflows of ₹950 crores, while DIIs bought ₹700 crores worth of equities.

For more global insights, visit Reuters and FXStreet.

Technical Indicator Summary

| Index | RSI (14) | India VIX | Put-Call Ratio (PCR) |

|---|---|---|---|

| Nifty 50 | 48.75 (Neutral) | 13.20 (+2.3%) | 0.92 (Bearish) |

| Bank Nifty | 46.10 (Weak) | — | 0.88 (Bearish) |

Sector Performance

| Sector | Performance (%) | Outlook |

|---|---|---|

| IT | -0.75% | Under Pressure |

| Banking | -0.65% | Weak |

| FMCG | +0.15% | Defensive Buying |

| Auto | -0.30% | Range-bound |

| Metal | +0.25% | Strong |

Trading Strategy for 1st August 2025

Intraday Strategy

- Nifty 50: Watch 24,800 as intraday pivot. Sustaining below it can drag Nifty towards 24,700–24,650. On upside, resistance is seen at 24,900–24,950.

- Bank Nifty: Breakdown below 55,900 can lead to 55,600–55,500 levels. Resistance stands at 56,200–56,300.

- Trade with strict stop-loss as volatility is expected to rise.

- Focus on sectors like Metals for intraday buying opportunities.

Swing Strategy

- Nifty 50 forming lower highs indicates bearish bias. Short positions can be considered on rise towards 24,950 with SL above 25,050.

- Bank Nifty swing traders can look for shorts below 55,800 targeting 55,400 levels over 2-3 days.

- Maintain a neutral stance on long-term longs until clear breakout above 25,150 (Nifty) & 56,500 (Bank Nifty).

Get Our TradingView Indicator for Live Charts

Key Levels Table

| Index | Support Levels | Resistance Levels | Pivot Point |

|---|---|---|---|

| Nifty 50 | 24,700 / 24,650 | 24,900 / 24,950 | 24,800 |

| Bank Nifty | 55,800 / 55,500 | 56,200 / 56,300 | 56,000 |

Final Thoughts

The market is currently in a consolidation phase with a bearish undertone. Nifty and Bank Nifty are both trading below critical resistance levels. Unless there is a strong global trigger, the indices may remain under pressure. Traders should maintain a cautious approach, using trailing stop-losses on short positions and avoiding aggressive longs until confirmation of reversal patterns.

Sector rotation is evident, with Metals showing relative strength while IT and Banks lag behind. Option writers should monitor PCR levels closely as expiry approaches.

Disclaimer

This analysis is for educational purposes only. Trading in financial markets involves risk. Please consult your financial advisor before making any investment decisions. The author is not responsible for any losses incurred.