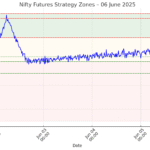

📌 Previous Session Recap:

Nifty displayed a strong upside recovery from intraday lows around 24,680, with a significant rally post-10:00 AM, closing near the 25,000 psychological level. The price action reflects bullish momentum, but profit-booking near resistance is evident.

🔍 Updated Support & Resistance Levels:

| Level Type | Price Range | Notes |

|---|---|---|

| Immediate Resistance | 25,000 – 25,020 | Price is hovering here; selling pressure seen |

| Next Resistance | 25,050 | Breakout confirmation if sustained above this |

| Immediate Support | 24,960 – 24,940 | Minor pullback zone |

| Critical Support | 24,900 – 24,880 | Bulls must protect this zone |

| Trend Support/Base | 24,830 | Strong trend base; break may turn bias negative |

🎯 Intraday Trading Strategy:

🔼 Bullish Scenario:

- ✅ Go long on breakout above 25,020, targeting 25,050 – 25,100.

- 📍 Stop-loss: Below 24,980.

- 🔁 Trail SL as price sustains above resistance.

🔽 Bearish Scenario:

- ⚠️ If price fails to sustain above 25,000 and breaks below 24,960, go short.

- 🎯 Target: 24,940, then 24,900.

- 📍 Stop-loss: Above 25,020.

⚖️ Neutral Bias Zone:

- Between 24,960 – 25,020, avoid aggressive trades. Watch for breakout/breakdown.

📈 Technical Indicators Outlook (Suggested to Use):

- Supertrend: Bullish; support near 24,880.

- VWAP/EMA: Price above VWAP and EMAs; favorable for long trades.

- RSI: Watch for overbought if it crosses 70 near 25,050 zone.

📅 Important Time-Based Zones (from previous chart patterns):

- 10:00 AM – 11:30 AM: High momentum, possible breakout window.

- 1:30 PM – 2:30 PM: Intraday reversal or continuation likely.